Free Interest-Only Loan Calculator for Excel (2025 Update)

In this article, we will explain how to use our interest-only loan calculator for Excel. Read on to learn more!

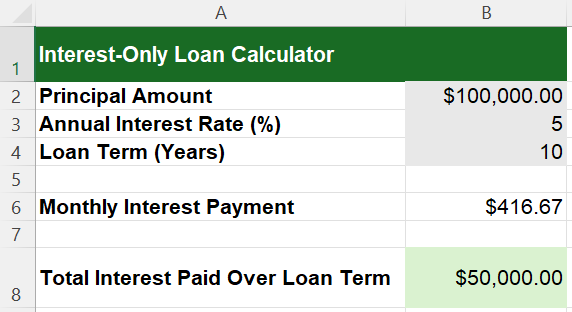

Simple Excel Interest-Only Loan Calculator

You can get a copy of our interest-only loan calculator for Excel here.

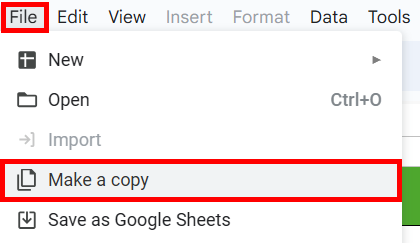

Do not request permission to edit. Simply go to File > Make a copy.

How to Use the Simple Interest Loan Calculator Excel Formula

Follow the steps below to learn how to use our interest-only loan calculator in Excel:

1. Open the Excel File

Open the Excel file with the simple interest-only loan calculator.

2. Enter Your Values

In cell B2, enter the Principal Amount of your loan. This is the total amount borrowed (e.g., 100,000).

In cell B3, enter the Annual Interest Rate (%). This is the yearly interest rate on the loan (e.g., 5).

In cell B4, enter the Loan Term (Years). This is the duration of the loan in years (e.g., 10).

3. Review the Calculations

The calculator should automatically calculate the following values:

Monthly Interest Payment

In cell B6, review the Monthly Interest Payment. This amount will be automatically calculated using the formula =B2 * (B3 / 100) / 12. The result shows how much you need to pay in interest each month (e.g., 416.67).

Total Interest Paid Over Loan Term

In cell B8, review the Total Interest Paid Over Loan Term. This amount will be automatically calculated using the formula =B6 * 12 * B4. The result shows the total amount of interest you will pay over the entire loan term (e.g., 50,000).

We hope that you now have a better understanding of how to use our Excel interest-only loan calculator. If you enjoyed this article, you might also like our articles on how to use our average daily balance calculator in Excel and our house construction cost calculator for Excel.