Free Income Tax Calculator for Excel (2025 Update)

In this article, we will explain how to use our free income tax calculator for Excel. Read on to learn more!

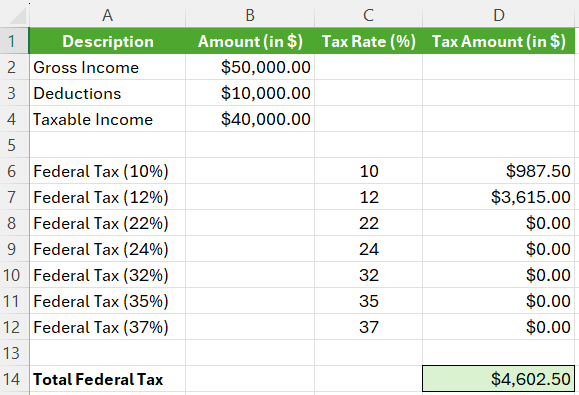

Income Tax Calculator Excel Template

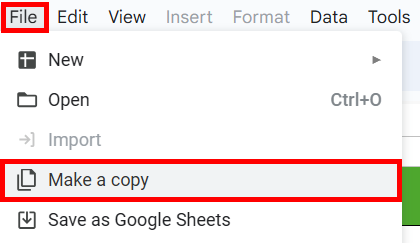

You can get a copy of our federal income tax calculator Excel template here.

Don’t request permission to edit. Simply go to File > Make a copy.

How to Use Our Income Tax Calculator for Excel

Below we explain step by step how to use our income tax calculator Excel template.

Step 1: Enter Your Gross Income

Enter your gross income in the cell under “Amount (in $)” for Gross Income. In our example, we have $50,000.

Step 2: Enter Your Deductions

Enter your deductions in the cell under “Amount (in $)” for Deductions (e.g., $10,000 in our example).

Step 3: Calculate Taxable Income

The Taxable Income will be automatically calculated in the “Taxable Income” row.

Step 4: Calculate Federal Tax

Our calculator uses the 2023 federal tax brackets and will automatically calculate the tax owed for each bracket.

Step 5: Display Tax Amounts

The Tax Amount for each bracket will be displayed in the corresponding cells under “Tax Amount (in $)”.

Step 6: Calculate Total Federal Tax

The Total Federal Tax will be the sum of the taxes calculated for each bracket and will be displayed in the “Total Federal Tax” row.

We hope that you now have a better understanding of how to use our income tax calculator for Excel. If you enjoyed this article, you might also like our articles on how to use our free savings interest calculator for Excel and our free student loan payoff calculator for Excel.